Introduction

A spread in forex might seem as a complex term but it is as simple as the business in a local shop where you buy from the wholesaler and sell to a customer. The price at which you buy from a wholesaler is always less than the price you receive from a customer in order to make a profit. If you buy a candy from the wholesaler for 8 cents and sell it to a customer for 10 your profit will be two cents, you would say even a 7 year old kid can make such simple calculations. Yes, the spread in forex is as simple as the calculations made by a 7-year-old in order to calculate the profit for a candy.

In a forex exchange you buy a currency and sell it like candy at a shop. You buy a currency at a price which is different from the price you sell it later. The difference between these two prices is known as the spread.

In a forex exchange the price at which a trader will buy a currency is known as “ask” price while the price at which a trader will sell a currency is called a “bid”. So, the difference between an “ask” and a “bid” is called a spread.

How to calculate the spread, and how much does it cost?

In order to calculate the spread three components are essential to understand which are,

- Ask

- Bid

- Difference in ask and bid

As mentioned above, ask is the price at which you buy a currency and bid is the price at which you sell a currency.

A difference between an ask and a bid price is usually calculated in pips. In case you don’t know what is a pip,

“A pip is the smallest unit of measurement which represents the minimal change in a currency pair value”.

For example, USD/JPY currency pair exhibits a change from 134.00 to 134.01, that is a change of one pip as,

134.01-134.00 = 0.01

The formula for calculating forex spread is,

| Bid (sell) | Ask (buy) |

| 1.300$ | 1.305$ |

| Spread = (Ask – Bid ) = 1.305$ – 1.300$ = 0.005$ | |

Forex spread = ask price – bid price

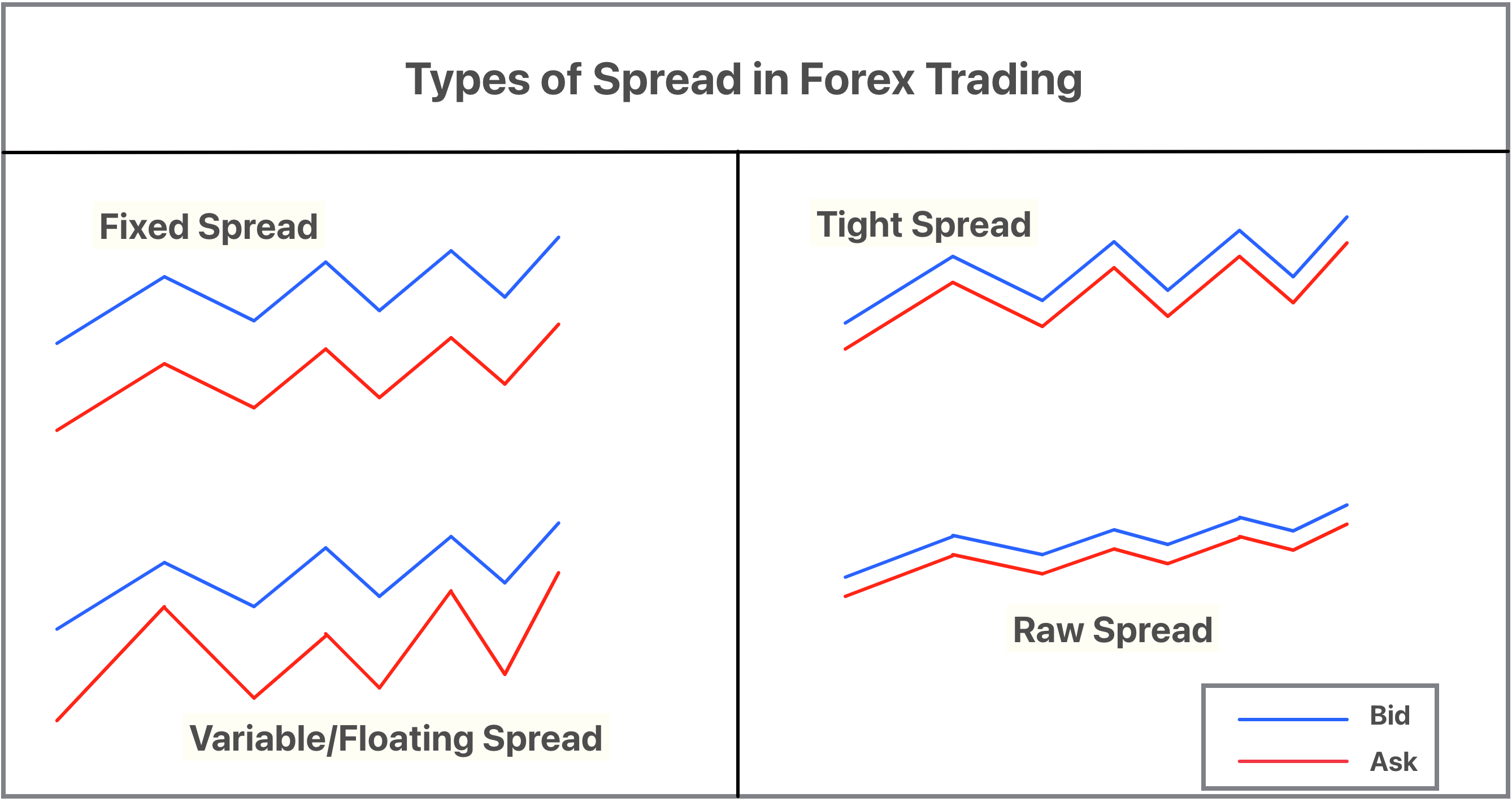

Types of Spread

There are two basic types of a forex spread.

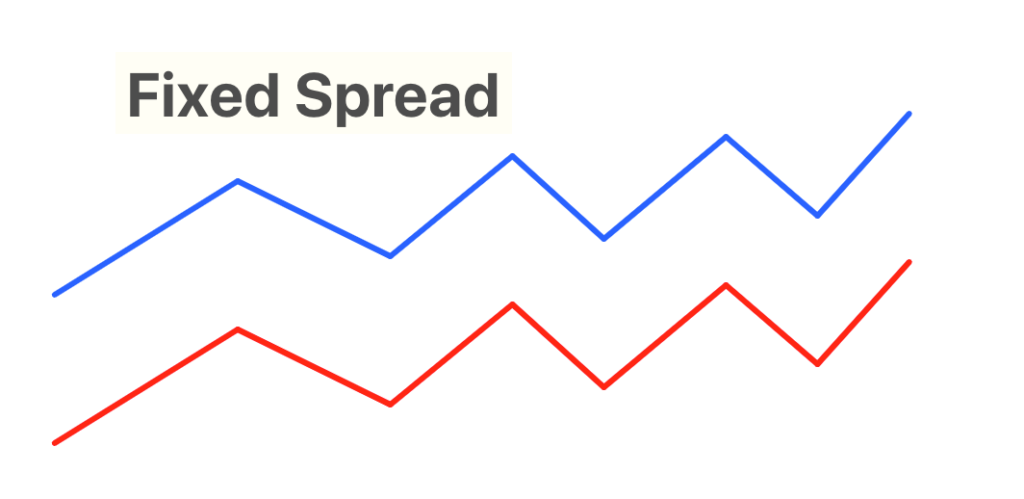

Fixed spread

A fixed spread does not depend on the volatility of a market. It remains the same throughout the trade no matter the change in the market. Trade volume also usually does not affect a fixed forex spread.

It is usually offered by a desk dealing model brokerage service in which a broker acts as a middleman between the trader and the liquidity provider.

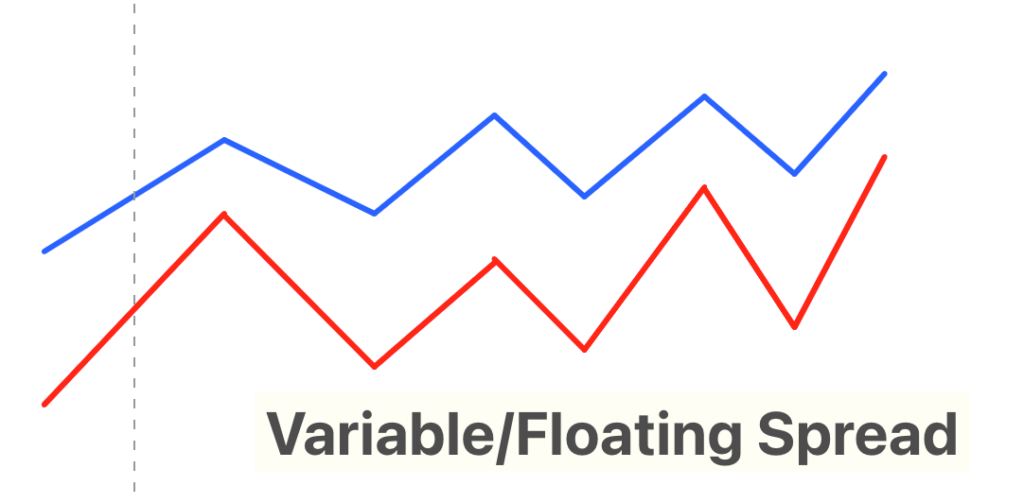

Variable spread

It is a type of forex spread in which the spread between an ask and a bid is constantly changeable and variable. The supply between ask and bid can be wider as well as tighter depending on market conditions. These market conditions usually include,

- Volatility

- Trade size

- Liquidity

A variable spread is usually derived by market and it is also known to be a floating spread.

Forex spread also have some other derived types as,

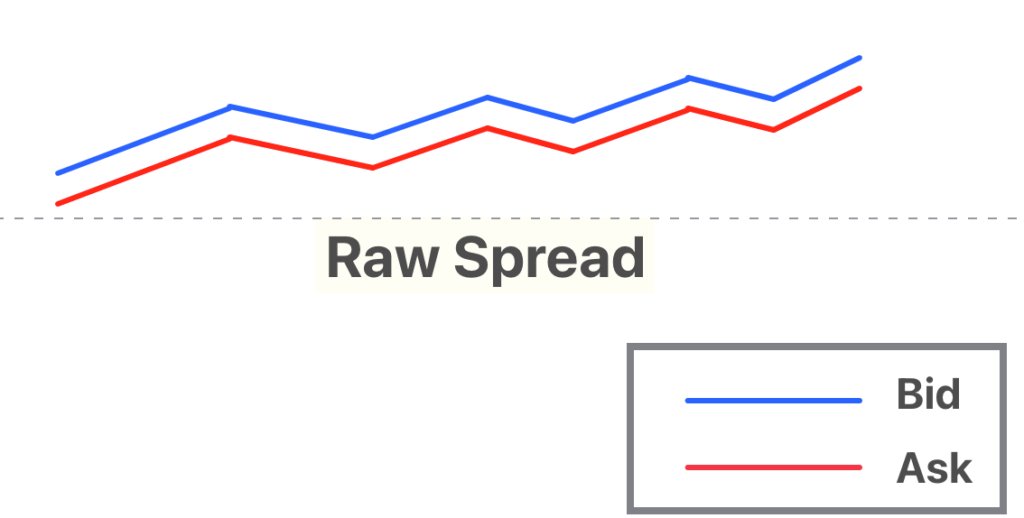

Raw spread

It is a type of forex spread in which a broker charges you are fixed commission or fee based on the interbank market prices. A broker do not control a raw spread as the prices are offered by interbank instead of him.

This type of spread offers lower cost, but profits are also compromised. The risk factor is also enhanced while choosing a raw spread.

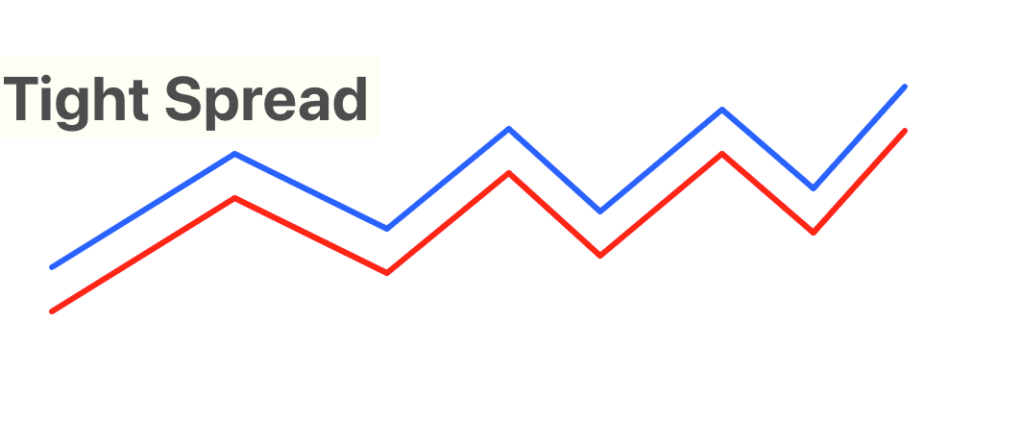

Tight spread

If the difference between buying and selling price is less the spread is known to be a tight one.

It is the most trader friendly spread as one can buy or sell a currency pair at decent prices which results in greater profits.

If market liquidity is higher a spread will be tighter.

Guaranteed spread

It is a type of separate in which the value of a spread remains constant throughout the trade no matter what are the market conditions. In a guaranteed spread the difference between an asking and a big price will remain constant throughout a given period of the trade. A guaranteed spread usually favors the traders who are keen to know the exact price or cost of their trade.

In a guaranteed spread type an offered spread is usually wider so a trader may not be able to get benefits when liquidity in a market is higher and a spread is tighter.

Advantages of spread types

Fixed and variable spread types offer following advantages,

| Advantages of Fixed spread | Advantages of variable spread |

| In a fixed spread a trader always knows the accurate and exact cost of a trade. High market events or volatility and low liquidity of a market do not affect your trading cost. It involves less risk with changing trends in a market. Offers a comparison between different prices while estimating a trade. | It is favorable during low volatility and high liquidityTrading costs are usually lower as compared to a fixed spread. Such spread is favorable in case of large trading volumeVariable spread usually do not involve any additional commissions are broker fee. |

Disadvantages of spread types

Everything in this world comes with pros and cons so each type of spread also has its cons. The disadvantages of a fixed and a variable forex spread may include,

| Disadvantages of a fixed spread | Disadvantages of a variable spread |

| Traders will not get any benefits when the conditions in the market are favorable and a spread is tighter. It usually involves a large amount of fee or commission. Such spread type involves less risk but profits are also compromised because of large broker commissions. There are always some additional broker commissions in a fixed spread. | During unfavorable market conditions a spread usually widens which results in additional trading costs. There is always a risk factor involved as a variable supplier usually depends on market volatility and liquidity. Traders cannot estimate the total cost of a trade while choosing a variable spread. A traitor cannot compare a broker fee to the other one as the cost of a variable spread is not fixed. |

How much does forex spread cost?

The cost of forest separate depends upon the following factors,

Currency pairs

The cost of forex prepared heavily relies on the currency pairs you are willing to trade in. The difference in an ask and a bid value is the key factor that determines your forex spread cost.

The cost of EUR/USD will be significantly different from the EUR/JPY or USD/JPY for the same trade size.

Broker

Brokers are a key factor in calculating a spread’s cost. Brokers are the main reason we have a forex spread, as they earn a fee from the price difference, just like a shopkeeper in the case of candy. In the case of USD/EUR, a broker may charge from 0.001 pip to 0.005. So, the larger the broker fee, the greater the forex spread cost.

Volume of a trade

The cost of a forest spread heavily depends on the size of the trade. What is the spread cost that will be higher for a standard lot as compared to a mini or a Nano lot?

As mentioned above the cost of a Ford explorer is not a fixed amount for a certain trade. As it depends on multiple factors, the cost of a trade spread will vary from trade to trade.

The bottom line

Choosing a forex spread type is directly proportional to one’s trading profits and losses. Forex spread is also vital while estimating the cost of a trade. As mentioned above every forex spread type has its pros and cons so choosing a spread type is one’s personal choice. In a general perspective traders playing with large trading size usually tend to go with a variable spread while beginners and low trade volume size traders opt for a fixed forex spread.